What Does Opening Offshore Bank Account Do?

Table of ContentsSome Known Incorrect Statements About Opening Offshore Bank Account The 2-Minute Rule for Opening Offshore Bank AccountIndicators on Opening Offshore Bank Account You Should KnowOpening Offshore Bank Account for Dummies

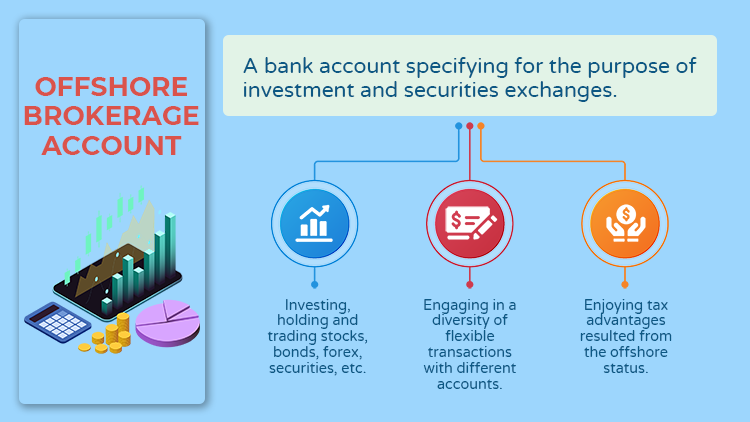

When you participate in overseas banking, you do so with a financial institution outside your residence country. In order to open an account with an offshore bank, you will certainly need to provide proof of your identity and various other files to prove your identity. Financial institutions may also call for information on the resource of your down payments.Individuals that bank offshore do so in a part of the world outside their home nation. Because of this, the term offshore financial is generally made use of to explain international financial institutions, business, and financial investments. Some areas have actually come to be well-known locations of overseas banking consisting of Switzerland, Bermuda, or the Cayman Islands. Various other nations where overseas financial takes area aren't that typical such as Mauritius, Dublin, as well as Belize.

Offshore financial is often gone over in a negative light. That's because many individuals utilize it as a way to hide their cash and also stay clear of paying tax obligations.

Second, several overseas banks ask about the nature of deals anticipated to happen through the account. This may appear excessively intrusive, however offshore banking facilities have actually been under increasing stress to quit illegal task. For this function, several offshore financial institutions desire additional documentation, keeping in mind the source of funds you are depositing in the bank.

Opening Offshore Bank Account for Beginners

If your money comes from an inheritance, the bank might request for a letter from the administrator of the estate testifying to this result. Unlike residential accounts, offshore savings account provide the alternative of the currency in which you wish to hold your funds. This can be a very useful function of an overseas account, especially if one's domestic money is unpredictable or expected to depreciate. The systems that allow complimentary electronic transfers typical in residential financial are generally not able to move cash worldwide. Sending a cord transfer is an easy operation, however nearly all banks bill international cord transfer charges to send out or get funds. Pricing for wire transfers differs between financial institutions, so make sure to seek offers.

By doing this, digital wire transfers can be made use of to move larger quantities of offshore funds to a domestic account where they can be conveniently accessed. This method uses greater privacy and safety, while additionally supplying the benefit of local banking solutions. Despite the aura surrounding them, it is relatively easy to charge account with offshore financial institutions.

Choosing the very best currency as well as enhancing down payments and withdrawals are somewhat much more difficult, yet the most effective selections come to be clearer as you research the choices. When using offshore savings account as well as getting global cable transfers, it is visit their website crucial to seek advice from a tax obligation expert to guarantee you are complying with all the tax obligation guidelines in your home as well as abroad.

Opening Offshore Bank Account Fundamentals Explained

Offshore financial is just a term used to describe making use of banking solutions in a foreign territory beyond the nation where one lives. Any type of individual who possesses a financial institution account in a foreign country outside of their country of house is engaging in offshore financial. If you are a UK citizen and also open an account in the US, that can be taken into consideration an offshore checking account.

That being claimed, there are still specific territories (such as Singapore, Belize, Cayman Islands and Switzerland) that are a lot more distinguished for their usage as beneficial offshore settings that have a perfect mix of financial advantages along with strong financial plans and also techniques. Because each territory is special they each have their own pros and disadvantages therefore the selection where to open up an overseas account will certainly vary according to private demands and also conditions - opening offshore bank account.

If, however, you would like to open an individual account with a reduced down payment limit, as well as would rather do it all online then perhaps Belize might benefit you. Table of Material: Offshore financial gives a number of advantages that can not be found in your regular domestic banking system.

Why? We shall see soon. Financial in an offshore jurisdictionminimizes your danger while boosting your monetary liberty offering you adaptability and defense of your possessions. Lots of people recognise the relevance of expanding possessions, however few individuals take into consideration diversifying across different important source places. There are a couple of different methods which one can tackle opening up an worldwide financial institution account, along with different account types, which we will briefly discover: While it site here is possible to open a personal offshore account in your own individual name, it is normally advised to incorporate an overseas firm in an international jurisdiction and also subsequently open a business account under the name of the business.

Opening Offshore Bank Account Can Be Fun For Anyone

You will likely need a large amount of documentation, references and so on in addition to a large preliminary deposit, and even after that there are no guarantees of being approved. opening offshore bank account. Opening up an account in the name of an overseas firm separates and dis-identifies you directly from the account. This suggests that your properties will be much safer as well as much less open up to undesirable focus.